Crypto have taken the world by storm, with more and more people becoming interested in investing in this digital asset. With the rise of new cryptocurrencies and the increasing popularity of blockchain technology, it’s no surprise that many individuals are looking to get involved in the crypto market.

However, for beginners, navigating the world of cryptocurrency can be overwhelming and confusing. One of the first steps to investing in cryptocurrency is choosing the right exchange to buy and trade your coins. With hundreds of exchanges available, it can be challenging to determine which one is the best for beginners.

In this article, we will take a deep dive into the top crypto exchanges for beginners in 2023, 2024. We will discuss their features, fees, security measures, and user-friendliness to help you make an informed decision when starting your crypto journey.

Table of Contents

ToggleTop 10 Best Crypto Exchanges

Listed below are the 10 best crypto exchanges for beginners in the market right now:

- MEXC – The Ultimate Cryptocurrency Exchange of 2023

- OKX – A Premier Exchange Offering Low Fees and Passive Income Services

- BingX stands out for its high-leverage Futures, Copy Trading, and Grid Trading features.

- Binance – The Largest Exchange Boasting Highest Daily Trading Volume

- Coinbase – A Secure Cryptocurrency Exchange with Top-notch Security Features

- eToro – The Ideal Exchange for Cryptocurrency Beginners

- Kraken – Trading Crypto with Leverage of Up to 5x

- Robinhood – Buy and Sell Crypto with Transactions Starting from Just $1

- Webull – A Regulated Crypto Exchange Offering 0% Commission Trading

- Crypto.com – Instantly Acquire Crypto with ACH on a Fee-Free Basis

1. MEXC – The Ultimate Cryptocurrency Exchange of 2023

Established in 2018, MEXC transcends borders, catering to over 170 countries and a user base exceeding 10 million. Crafted by banking industry experts, this feature-rich exchange boasts a capacity of 1.4 million transactions per second, delivering unparalleled efficiency and performance.

MEXC dominates crypto trading with 1600+ coins, featuring 0% spot trading fees, up to 200x leverage, and minimal maker and taker fees at 0.00% and 0.02%. The platform ensures transparency with a 1:1 proof-of-reserve for user assets in Spot, Fiat, and Futures wallets, covering ETH, BTC, USDT, and USDC.

Catering to both seasoned traders and novices, MEXC incorporates advanced charting tools with indicators and drawing features, as well as a unique copy trading option. Additionally, a savings feature lets users lock various coins to earn diverse APRs.

MEXC, accessible via a user-friendly app on iOS and Android, offers on-the-go trading with payment methods such as debit/credit cards, bank transfers, and more. Setting itself apart, MEXC introduces the MX token, providing holders with decision-making power, discounts, and airdrop participation. Undoubtedly, MEXC leads as a comprehensive and diverse crypto exchange in 2023. Note that MEXC is currently unavailable in the United States, with recommended alternatives being Coinbase or Binance for US-based traders.

| Criteria | MEXC |

|---|---|

| Number of Cryptos | 1600+ |

| Fiat Deposit Fees | 2% fee for USDT purchase with debit/credit card |

| Fee to Buy Bitcoin | 0% |

| Proprietary Wallet? | No |

| Top Features | 0% spot trading fees; advanced charting features; Copy trading for copying other seasoned traders; future trading with 200x leverage; 1:1 proof-of-reserves for BTC, ETH and other assets; professionally developed platform supporting 1.4m transactions per second. |

| Pros | – 1600+ coins |

| – Margin and futures (200x leverage) trading | |

| – Competitive fee structure | |

| – Fee-free spot trading | |

| – Copy trading feature | |

| Cons | – Proof-of-Reserves is only for some assets |

| – Access and features limited in some regions |

2. OKX – A Premier Exchange Offering Low Fees, Passive Income Services

Distinguished as a top-tier P2P cryptocurrency exchange, OKX shines with its comprehensive suite of trading services. Particularly notable is its crypto spot trading platform, which features some of the most competitive fees in the market—merely a 0.1% charge for each buy and sell order. Traders can unlock additional benefits by enjoying reduced commissions as they reach higher 30-day trading volume milestones.

OKX’s exchange platform caters to a diverse portfolio of over 370 markets, encompassing premier long-term cryptocurrencies and promising low-cap alternatives. A standout feature is OKX’s recognition as one of the preeminent decentralized exchanges, making it especially attractive for those seeking passive income streams. For example, depositing Bitcoin into a savings account yields an impressive APY of 5%, while tokens like Near Protocol and Elrond offer even more enticing returns at 35.5% and 36%, respectively. This solidifies OKX’s position as a leading platform for crypto staking enthusiasts.

In our in-depth OKX review, we uncovered its support for advanced crypto trading products, including perpetual swaps, futures, and options. Additionally, OKX provides a dedicated crypto wallet app, ensuring a noncustodial approach where investors retain control over their private keys.

OKX goes beyond basic offerings by providing traders with advanced analysis tools, integrating seamlessly with TradingView, and offering charting timeframes ranging from one second to three months.

| Criteria | OKX |

|---|---|

| Number of Cryptos | 370+ |

| Fiat Deposit Fees | Built into the exchange rate |

| Fee to Buy Bitcoin | Up to 0.1% |

| Proprietary Wallet? | Yes |

| Top Features | Earn interest on idle cryptocurrencies; Over 370+ spot trading markets; Also offers a DEX with thousands of supported tokens; Low trading fees; Supports crypto derivative trading |

| Pros | Spot trade 370+ cryptocurrencies at a 0.1% fee. |

| Earn high yields via savings and staking. | |

| Use a proprietary noncustodial wallet. | |

| Access crypto derivatives like futures and options. | |

| Cons | Fees for fiat deposits become visible only upon order creation. |

3. BingX- high leverage Futures, Copy Trading, Grid Trading features

BingX provides a range of products, including Futures trading with leverage up to 150x, Copy Trading to replicate successful strategies, Grid Trading, and more.

Established Since 2018: With its founding year in 2018, BingX has some history in the cryptocurrency space.

P2P Transactions: Deposits and withdrawals on BingX are 100% free through P2P transactions, providing cost-effective options for users.

Innovative Features: The platform offers innovative features such as Copy Trading, allowing users to follow and emulate the trades of successful investors.

| Criteria | BingX |

|---|---|

| Year Founded | 2018 |

| Headquarters | Singapore |

| Products | Futures Trading: Leverage up to 150x |

| Copy Trading: Replicate successful trades | |

| Grid Trading: Implement grid trading | |

| … (and more) | |

| Deposits and Withdrawals | 100% free through P2P transactions |

| Minimum Deposit/Withdrawal | N/A |

| Supported Methods | ATM |

| Bank Accounts | |

| E-Wallets: MoMo, ZaloPay, and others | |

| Pros | Diverse product offerings, including Futures, Copy Trading, and Grid Trading. |

| Established since 2018. | |

| Cost-effective P2P transactions for deposits and withdrawals. | |

| Innovative features like Copy Trading. | |

| Cons | Considered relatively young in the industry. |

| Limited information |

4. Binance – The Largest Exchange Boasting Highest Daily Trading Volume

Binance, a crypto giant with daily volumes exceeding $10 billion, stands out for its liquidity and low fees. Offering 0% commission on major crypto trades and nominal fees elsewhere, it caters to diverse markets and rewards BNB token holders with reduced fees.

Beyond traditional trading, Binance features comprehensive crypto derivatives with leverage options. Earning avenues include staking and liquidity farming. Supporting multiple fiat currencies and payment methods, including peer-to-peer options, Binance ensures flexibility in fund deposits. While debit/credit card fees average 1.8%, the exact amount varies by location, enhancing accessibility for global users.

| Criteria | Binance |

|---|---|

| Number of Cryptos | 350+ |

| Fiat Deposit Fees | Averages 1.8%, varies by location |

| Fee to Buy Bitcoin | From 0% |

| Proprietary Wallet? | Yes |

| Top Features | Largest crypto exchange for volume and liquidity; spot trading and derivative markets; Trading commissions start from 0% on selected pairs; Earn passive income through staking and other APY tools |

| Pros | – 120 million registered users |

| – Largest crypto exchange for daily trading volume | |

| – Trade over 350 spot markets | |

| – Also supports futures, options, and leveraged tokens | |

| – Super-low trading fees | |

| Cons | – Many supported products are not suitable for beginners |

5. Coinbase – A Secure Cryptocurrency Exchange with Top-notch Security Features

Coinbase, established in 2012 with a customer base exceeding 100 million traders, is a regulated US exchange providing a secure platform for trading over 250 cryptocurrencies. While it offers a straightforward investment process and industry-leading security features, such as mandatory two-factor authentication and 98% of client digital assets stored in cold storage, Coinbase is criticized for its relatively high fees. A standard commission of 1.49% applies to buy and sell orders, and for transactions under $200, a less favorable flat fee comes into play. Deposit fees for debit/credit cards and PayPal are 3.99%, including the commission. Despite the fees, Coinbase remains popular for its user-friendly interface.

The platform supports both web and mobile trading, and clients can earn passive income through staking, with Polkadot and Avalanche offering APYs of 14.34% and 8.935%, respectively. It’s worth noting that staking is not available to US clients.

| Criteria | Coinbase |

|---|---|

| Number of Cryptos | 250+ |

| Fiat Deposit Fees | 3.99% on debit/credit cards and Paypal |

| Fee to Buy Bitcoin | From 1.49% |

| Proprietary Wallet? | Yes |

| Top Features | Safe and secure trading environment; Over 250 cryptos supported; Offers a noncustodial wallet |

| Pros | – Buy and sell more than 250 cryptos |

| – Easy fund deposits with debit/credit cards or Paypal | |

| – No fees on domestic bank transfers | |

| – Earn interest on idle tokens via staking | |

| Cons | – 3.99% deposit fee to buy crypto with a debit/credit card |

6. eToro – The Ideal Exchange for Cryptocurrency Beginners

eToro provides a user-friendly interface tailored for beginners to easily view, explore, and trade cryptocurrencies. A standout feature is its unique offering of traditional stocks and securities, making it an ideal choice for those seeking a diversified portfolio. eToro also supports numerous new cryptocurrencies.

For funding trading accounts, users can initiate deposits through e-wallets and bank transfers. Notably, eToro boasts some of the lowest fees in the industry, with traders paying a commission of just 1% of the total transaction amount.

Established in 2007, eToro has earned its status as a premier exchange with a massive user base of over 30 million traders globally. In addition to its extensive track record, eToro provides a user-friendly crypto wallet app for both iOS and Android, enabling traders to conveniently manage their holdings and trades while on the move. eToro’s innovative copy trading tool further sets it apart, allowing users to effortlessly replicate the orders of experienced investors.

| Criteria | eToro |

|---|---|

| Number of Cryptos | 90+ |

| Fiat Deposit Fees | No fees on USD deposits. 0.5% on non-USD payments. |

| Fee to Buy Bitcoin | 1% plus the market spread |

| Proprietary Wallet? | Yes |

| Top Features | Regulated, with a proprietary web and mobile wallet, eToro offers fee-free USD deposits (including debit cards) and supports a variety of assets, including stocks and ETFs. |

| Pros | – Supports Bitcoin and 90 of the best altcoins |

| – Low minimum deposit amount (varies by region) | |

| – Smart portfolios and copy trading tools | |

| – Native web and mobile wallet | |

| Cons | – 0.5% deposit fee on non-USD payments |

7. Kraken – Trading Crypto with Leverage of Up to 5x

Founded in 2011, Kraken launched its dedicated cryptocurrency exchange in 2013, featuring support for a diverse range of over 200 cryptocurrencies on its spot trading platform. From Bitcoin and Cosmos to Waves, Polygon, Ripple, and Ethereum, Kraken caters to a wide spectrum of digital assets. Additionally, the platform supports leveraged trading, offering up to 5x leverage across more than 100 markets, with higher margin trading limits accessible to professional crypto traders.

Although Kraken may not be the most cost-effective crypto exchange, its fees remain reasonable. Market takers face a 0.26% fee for spot trading, with reductions as trading volumes increase. Margin trading fees average 0.02% per four-hour interval a position is held. For deposits, Kraken charges a 3.75% fee on debit/credit cards, but ACH and wire transfers offer more cost-effective alternatives. It’s worth noting that Kraken does not offer its proprietary crypto wallet.

| Criteria | Kraken |

|---|---|

| Number of Cryptos | 200+ |

| Fiat Deposit Fees | 3.75% on debit/credit cards. Local banking methods, such as ACH, are much cheaper. |

| Fee to Buy Bitcoin | Up to 0.26% |

| Proprietary Wallet? | No |

| Top Features | Founded in 2011; More than 200+ cryptos supported; Up to 5x leverage on 100+ markets |

| Pros | – One of the best crypto exchanges for margin trading |

| – Supports over 200 crypto pairs | |

| – Founded in 2011, launched in 2013 | |

| – Advanced trading tools for seasoned investors | |

| Cons | – 3.75% charge on debit/credit card payments |

| – Lack of transparent display of deposit fees |

8. Robinhood – Buy and Sell Crypto with Transactions Starting from Just $1

Robinhood is a popular crypto exchange based in the US. caters to traders by allowing them to purchase cryptocurrencies starting from just $1, irrespective of the token’s market price. This accessibility appeals to those seeking diversification with a modest investment. Renowned for its low fees, Robinhood stands out by not charging any commissions for crypto trading. Furthermore, the platform extends its 0% commission offering to stocks, ETFs, and US-listed options.

With support for 18 cryptocurrencies, including Bitcoin, Tezos, USD Coin, Chainlink, Ethereum, and Dogecoin, In terms of security, all Robinhood users are required to go through a KYC process. Moreover, the majority of client digital assets are stored securely in cold storage.

Robinhood insures against crypto crimes, recently introducing a web3 wallet for fee-free token operations on iOS. Android users can expect the wallet app later. The platform ensures 24/7 customer support via live chat and phone.

| Criteria | Robinhood |

|---|---|

| Number of Cryptos | 18 |

| Fiat Deposit Fees | None |

| Fee to Buy Bitcoin | 0% commission, plus market spread |

| Proprietary Wallet? | Yes – iOS only (Android coming soon) |

| Top Features | Regulated by FINRA; 0% commission crypto trading; Buy crypto from just $1 |

| Pros | – Invest in cryptocurrencies from just $1 |

| – Zero commissions on crypto, stocks, ETFs, or options | |

| – Regulated in the US | |

| Cons | – Limited to 18 supported cryptocurrencies |

| – Limited analysis tools |

9. Webull – Top 10 Best Crypto Exchanges, Offering 0% Commission Trading

Webull, a US-based crypto exchange regulated by FINRA and the SEC, offers support for over 40 cryptocurrencies, all paired with the USD. This encompasses popular options like Bitcoin, Ethereum, Litecoin, Dogecoin, and Bitcoin Cash, as well as various DeFi coins including Sushiswap, Loopring, Compound, and Aave. Notably, all supported cryptocurrencies can be traded on Webull with 0% commission.

It’s important to note that Webull has an average market spread of 1%, so consider this factor. The minimum requirement for a crypto trade on Webull is just $1. In terms of trading tools, Webull stands out as one of the best crypto exchanges, providing real-time market data, customizable charting screens, and support for numerous technical indicators. Additionally, Webull offers a free demo account with $1 million in paper trading funds. Security measures include two-factor authentication and cold storage for trading accounts on Webull.

| Criteria | Webull |

|---|---|

| Number of Cryptos | 40+ |

| Fiat Deposit Fees | None |

| Fee to Buy Bitcoin | 0% commission plus a 1% market spread |

| Proprietary Wallet? | No |

| Top Features | Zero-commission trading; Minimum trade of just $1; Suitable for both beginners and seasoned traders |

| Pros | – Zero-commission on 40+ crypto pairs |

| – No deposit fees | |

| – Regulated by FINRA and the SEC | |

| – Also supports thousands of stocks and ETFs | |

| Cons | – Limited range of penny cryptos |

| – Does not offer a proprietary crypto wallet |

10. Crypto.com – Top 10 Best Crypto Exchanges

Crypto.com stands out as a top-tier crypto exchange for purchasing digital assets using ACH. ACH deposits are not only fee-free but are processed instantly. To utilize this feature, investors can download the free Crypto.com app, available on both iOS and Android devices. he Crypto.com app also supports instant debit/credit card payments, but this is charged at 2.99%. With support for over 250 digital assets, Crypto.com offers an ideal platform for diversification.

Crypto.com offers ultra-low trading fees starting at 0.075%, with potential discounts for higher volumes. It’s a top choice for passive income with APYs reaching up to 6.5% on stablecoins. Notable features include loans, a decentralized wallet, and an NFT marketplace.

| Criteria | Crypto.com |

|---|---|

| Number of Cryptos | 250+ |

| Fiat Deposit Fees | Fee-free ACH deposits; 2.99% for debit/credit cards |

| Fee to Buy Bitcoin | Up to 0.075% |

| Proprietary Wallet? | Yes |

| Top Features | Earn up to 6.5% on stablecoin deposits, enjoy fee-free and instant ACH payments, and access over 250 supported cryptocurrencies. |

| Pros | – Instant fee-free ACH deposits |

| – Trade over 250 cryptos | |

| – Competitive APYs on crypto savings accounts | |

| – Noncustodial wallet app for iOS and Android | |

| Cons | – 2.99% charge on debit/credit card payments |

| – Requirement to use the Crypto.com app for fiat deposits |

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is a third-party trading platform facilitating the buying and selling of digital assets. Some platforms concentrate on major cryptocurrencies such as Bitcoin and Ethereum, while others extend support to a wide array of altcoins. Similar to stock brokers, the trading process involves users registering an account, providing personal information, and making a deposit.

When making a deposit with fiat money, the exchange typically requires some form of identification to comply with anti-money laundering regulations. Following this verification, traders can purchase their preferred cryptocurrency, often incurring a small commission—this is how crypto exchanges generate revenue. Many crypto exchanges provide a proprietary wallet, allowing users to store their crypto tokens without the need for an external wallet.

When reviewing the best Bitcoin exchanges, we also found that top providers offer passive investment tools. For example, MEXC provides copy trading, enabling clients to invest without actively engaging in crypto buying and selling. Additionally, MEXC, OKX, and Binance offer interest-bearing accounts, allowing investors to earn an APY on idle crypto tokens.

How Cryptocurrency Trading Platforms work?

Cryptocurrency exchanges generally follow a similar operational pattern. As mentioned earlier, traders establish an account funded with fiat money, which can then be exchanged for cryptocurrencies. Leading crypto exchanges facilitate seamless transactions through convenient payment methods, including debit/credit cards, ACH, and e-wallets.

Trading on an exchange relies on having a counterparty—a seller on the other side of the trade. This underscores the significance of liquidity when selecting an exchange. Inadequate liquidity can impede traders from executing buy or sell orders efficiently. Some exchanges incentivize liquidity providers with interest.

Liquidity is crucial for traders to exit positions at their discretion. Opting for an exchange with a substantial user base, like MEXC with over 10 million users, is vital, as it ensures the ability to execute trades promptly and efficiently.

Another method of diversification involves utilizing a copy trading service, allowing users to automatically replicate the trades of experienced traders. Several exchanges now provide this feature, enhancing the options for traders seeking a diversified approach to their investments.

Some Tips On How To Choose The Best Crypto Exchange

Regulation

In contrast to stock brokers, the majority of crypto exchanges function without a regulatory license due to the unregulated nature of crypto assets in many countries. However, opting for an exchange regulated in your region provides an added layer of assurance.

Tradable Cryptos

Diversification is a key strategy in crypto trading, and the best exchanges provide a diverse selection of cryptocurrencies. MEXC, for instance, supports over 1600 cryptos, encompassing both large-cap and small-cap projects.

Another method of diversification involves utilizing a copy trading service, allowing users to automatically replicate the trades of experienced traders. Several exchanges now provide this feature, enhancing the options for traders seeking a diversified approach to their investments.

Fees

Top crypto exchanges feature competitive deposit and trading fees, with variations based on the payment method. Bank transfers are usually fee-free, while debit/credit card or e-wallet deposits may incur charges.

Consider these key trading commissions:

- OKX charges a minimal 0.1% on buy and sell orders.

- Coinbase imposes a 1.49% fee on buy and sell orders.

- MEXC provides spot trading with a 0% commission.

Note that exchanges may offer fee reductions for payments in their native tokens or for holding the token for a specific period. For example, Binance offers a 25% fee reduction with BNB, and MEXC provides a 50% discount on futures trading fees for those holding 1000 MX or more for 15 consecutive days. Additionally, reduced commissions may apply based on higher trading volumes within the last 30 days.

Payment Methods

When choosing the best Bitcoin exchange, consider available payment methods, as deposits are essential for crypto purchases. While most exchanges accept debit/credit cards, fees vary (e.g., MEXC’s lower fees around 2%). Some also support e-wallets like PayPal, Neteller, and fee-free local bank transfers (ACH, SEPA).

Customer Service

For the best Bitcoin trading platform, prioritize 24/7 customer service, preferably with live chat support to avoid delays associated with email responses.

Tools & Features

Top crypto exchanges provide diverse tools beyond basic trading services. For instance:

MEXC introduces a copy trading tool, allowing users to replicate successful traders’ moves automatically.

OKX offers passive income tools like crypto savings accounts with competitive APYs, without minimum lock-up requirements.

Binance caters to advanced traders with crypto derivatives, including futures and options with leverage, short-selling capabilities, and advanced charting tools with technical indicators.

How do Crypto Exchange Fees Work

Deposits and Withdrawals

Some crypto exchanges charge deposit and withdrawal fees. This will often depend on the preferred payment type. Debit/credit card and e-wallet payments are usually the most expensive, averaging 3-5%. At MEXC this fee is lower, at approximately 2%. Many crypto exchanges offer fee-free deposits and withdrawals via ACH, domestic bank wires, and other local networks (such as SEPA / UK Faster Payments). When depositing crypto, rarely do fees apply. However, crypto withdrawals will often attract a fee. This should mirror the blockchain network fee at the time of the withdrawal.

Trading Commissions

Most crypto exchanges make money by charging trading commissions. This is usually a percentage of the trade amount. For example, OKX charges a commission of 0.1%. This means that for every $1,000 traded, a fee of just $1 will apply.

Notably, Coinbase operates with a higher trading commission of 1.49%, resulting in a $14.90 fee for a $1,000 trade. It’s worth mentioning that some exchanges provide discounts on trading commissions for larger volumes or when using the platform’s native token.

Market spreads

Market spreads, representing the difference between the ‘bid’ and ‘ask’ prices, are inherent in cryptocurrency trading. Although not always explicitly displayed, they play a crucial role in determining trading costs.

For instance, if Ripple is priced at $0.50,

traders might encounter a buying price of $0.51

selling price of $0.49.

This price difference ensures a profit for the exchange, regardless of Ripple’s market movement.

It’s noteworthy that some crypto exchanges may not transparently disclose market spreads, necessitating traders to calculate them independently.

How to buy best crypto exchanges for beginners?

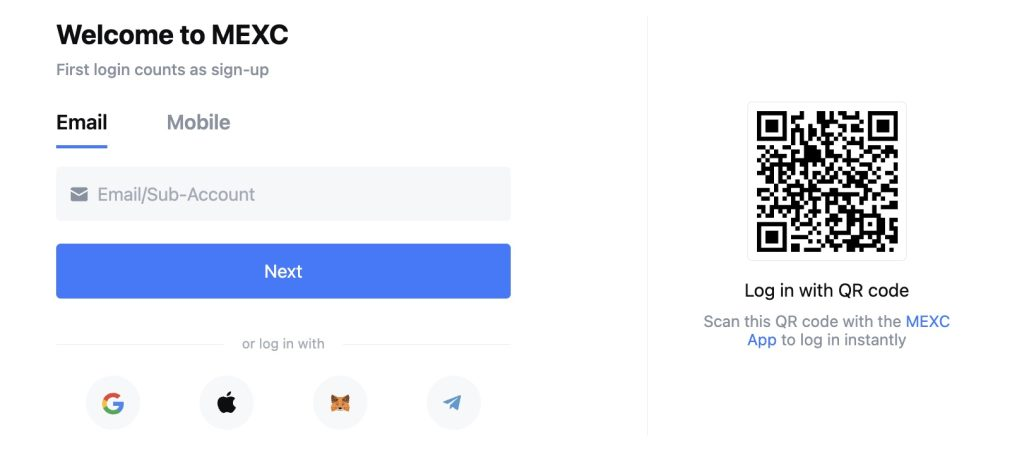

Example how to sign up and begin trading at MEXC.

Step 1: Sign up a MEXC Account

Step 2: KYC account

MEXC offers two levels of KYC verification: Primary and Advanced. For most users, Primary KYC is sufficient, allowing withdrawals of up to 80 BTC within a 24-hour period. Primary KYC entails submitting a government-issued ID, like a driver’s license or passport, with document review and KYC approval typically processed within 24 hours.

Users who wish to deposit and withdraw up to 30 BTC in a 24-hour period are exempt from completing KYC. However, individuals looking to purchase crypto with fiat currency are always required to undergo the KYC process.

Step 3: Make a Deposit

After successful KYC approval, you can acquire cryptocurrencies on MEXC using various methods. The platform utilizes USDT, a stablecoin pegged to the US Dollar, as its primary currency. Users will exchange their native currency for USDT to engage in trading on the platform.

MEXC accepts payments through the following methods:

- Visa and MasterCard

- Bank Transfer (SEPA)

- 3rd Party Services, such as MoonPay and Banxa

A fee of approximately 2% is applied to debit/credit card transactions, while bank transfers incur no fees. It’s important to note that 3rd party services may have their own associated fees.

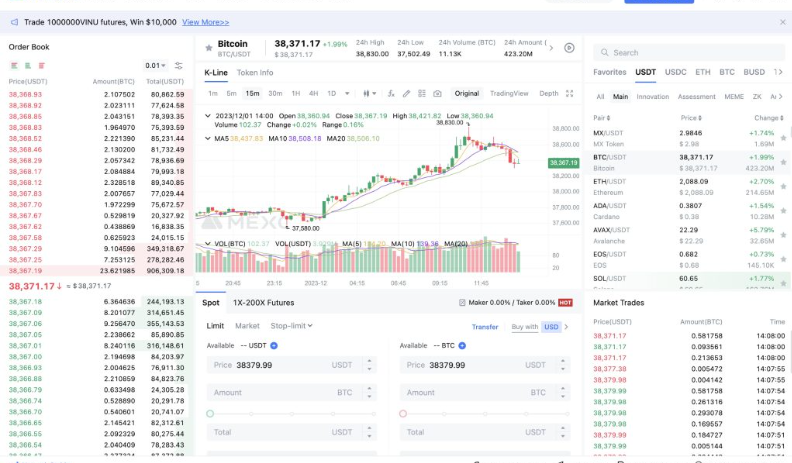

Step 4: Trade Crypto

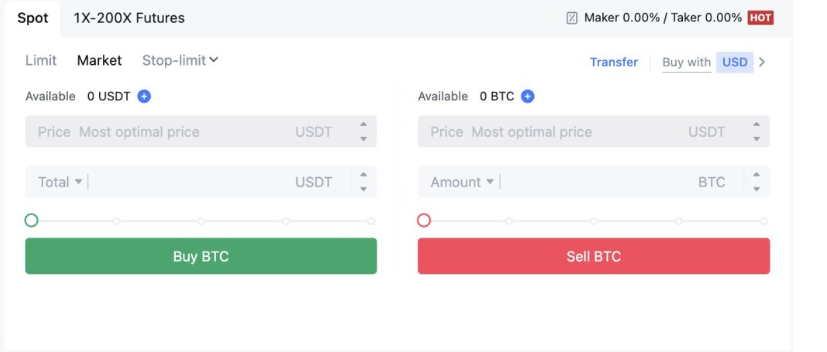

Now that you have USDT in your account you can trade it for another cryptocurrency. Click on ‘Spot’ in the menu bar and select ‘Spot’ to be taken through to the trading platform.

Use the search bar in the top right-hand corner of the trading platform to search for the cryptocurrency you want to buy.

Step 5: Buy Crypto

navigate to the ‘Market’ tab at the bottom of the page to secure the current market rate for your chosen cryptocurrency. Then, input the desired amount you wish to spend, or utilize the slider to choose a percentage of your available balance.

Click ‘Buy xxx’, and your trade will be executed, with your balance promptly updated to reflect the completion of your purchase.

Final Words

Choosing the appropriate exchange is a crucial decision when venturing into online crypto purchases. Investors should prioritize a platform with low fees, as well as a secure and reliable trading environment.

Our top recommendation for 2023 is MEXC. Boasting support for more than 1600 cryptocurrencies and a user base exceeding 10 million globally, MEXC stands out as a trusted choice for crypto enthusiasts.